ONESOURCE Superannuation Features

Reduce risk and save time efficiently

Automate superannuation tax with seamless data management, real-time analytics, and customisable reporting

Data centralisation

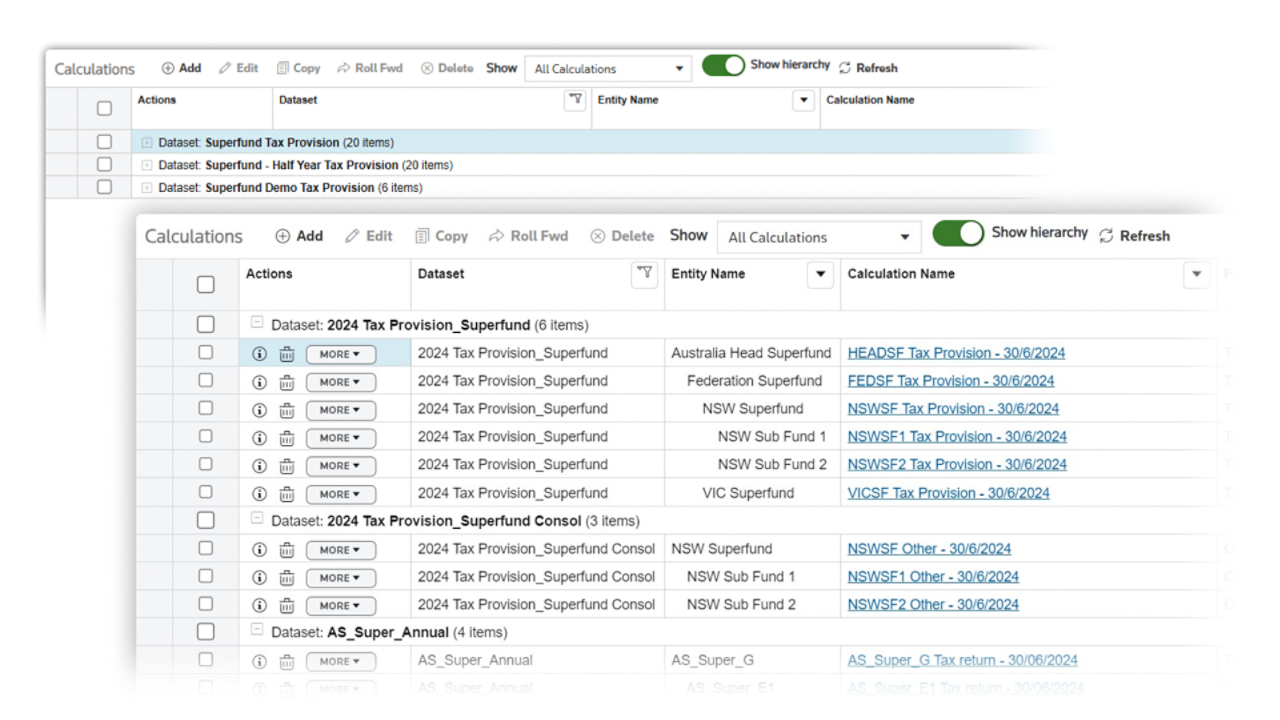

ONESOURCE serves as a comprehensive platform, consolidating all tax-related data and calculations for superannuation. It streamlines tax provision calculations, eliminating redundancies in reporting setups.

Automated integration

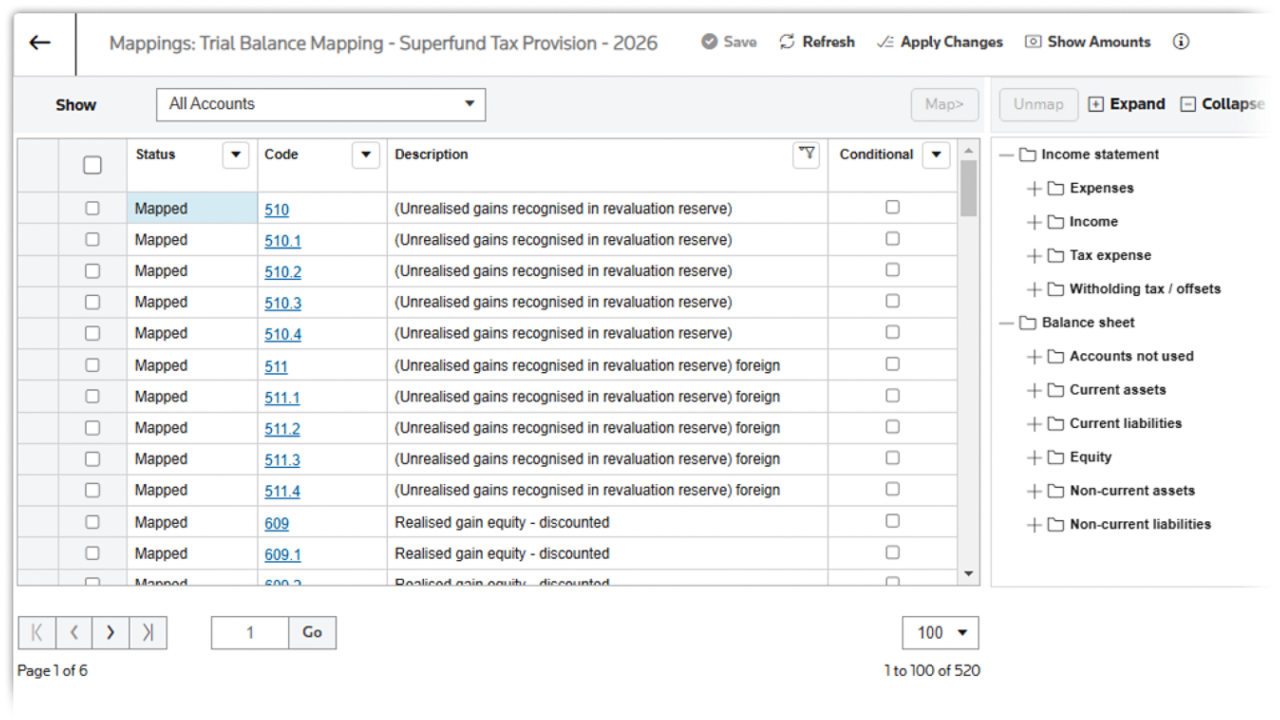

The platform seamlessly integrates with the general ledger, automating tax attribute data flows and minimising manual errors. It supports the upload of electronic source data, mapping which rolls forward, ensuring accurate integration of trial balances, and tax adjustments, thereby optimising the tax compliance workflow.

Talk to an expert

Unlock potential by automating tasks and focusing on strategic growth with ONESOURCE Superannuation.

Enhanced reporting

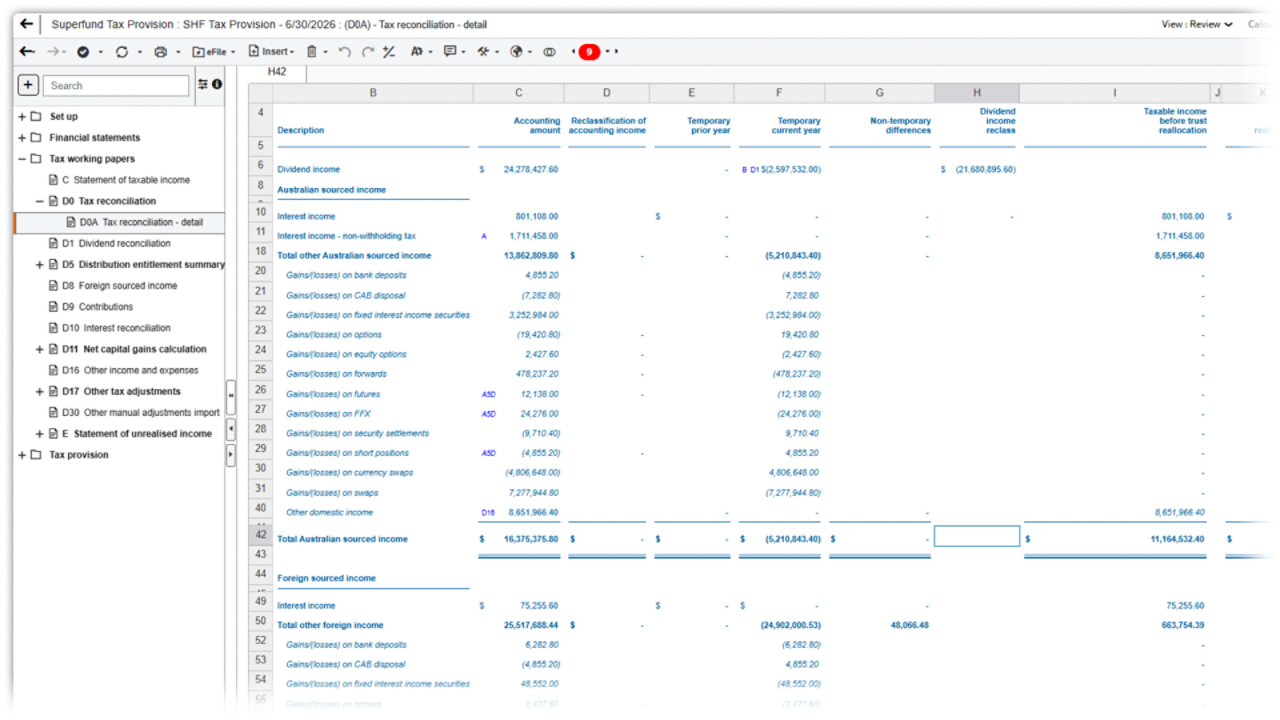

ONESOURCE enhances reporting precision with hyperlinked workpapers facilitates traceability, and consistent reporting features to ensure regulatory compliance. The platform benefits from regular updates and template maintenance by a trusted industry leader.

Frequently asked questions

ONESOURCE Superannuation is designed to meet the needs of mid-to-large investment fund managers, custodians, and superannuation fund administrators. It optimises tax planning and compliance, streamlining complex processes to enhance efficiency and accuracy.

ONESOURCE centralises data management and automates tax calculations, integrating seamlessly with general ledgers for efficient data flow. This reduces manual entry errors and time spent on tax provision calculations, ensuring compliance with tax regulations.

ONESOURCE Superannuation ensures reporting accuracy and quality with deliverable ready outputs such as tax reconciliation, statement of taxable income, tax journals and tax notes. Hyperlinked workpapers enhance traceability, ensuring consistent features across asset manager and owner deliverables, which supports regulatory compliance. ONESOURCE Superannuation also caters to enhanced reporting quality through the use of API’s and report format availability allowing better analytics and process automation with hyperlinked workpapers within and across each schedule.

The platform consolidates data from diverse sources into a centralised system, eliminating process duplication and enhancing data integrity. It supports electronic data uploads and seamless integration with existing systems, ensuring accurate and organised data management.

ONESOURCE solutions assist with third-party compliance and reporting by providing comprehensive tools for managing tax compliance, regulatory requirements, and financial reporting. Software solutions streamline processes, ensure accuracy, and help businesses adhere to various regulatory obligations. Our software solutions offer features such as automated data collection, real-time reporting, and analytics that enable organisations to efficiently manage compliance with third-party regulations and ensure overall reporting accuracy.

Experience it for yourself

Unlock potential by automating tasks and focusing on strategic growth with ONESOURCE Superannuation.

Have questions? Contact a representative