ONESOURCE Corporate Tax

Empower your tax team with agile cloud solutions

Transform your tax compliance processes. Streamline your returns and have control over your data.

Streamlined Corporate Tax Management

An end-to-end software automates data collection, streamlines tax calculations, and ensures seamless financial reporting, making tax management efficient and stress-free.

- Automated Precision: Our solution automates data collection and tax calculations, providing precise financial information for disclosures.

- Efficient Review Process: Benefit from flexible review functionality with an accurate audit trail, enabling quicker and more focused review efforts.

- Seamless Year-to-Year Transition: Relevant data is carried forward to the next reporting period, reducing setup time and streamlining preparation for the next year’s return.

Seamless Tax Integration

A comprehensive suite of components designed to ensure a seamless data flow from accounting systems to tax returns. This integration boosts productivity and minimises errors, providing a streamlined and efficient tax solution capable of addressing compliance and planning needs while supporting broader business objectives.

- Integrated Efficiency: Facilitates a seamless flow of data from source accounting systems to tax return lodgment, enhancing productivity and reducing errors.

- Comprehensive Solution: Addresses compliance and provides controls around accurate tax disclosures while expanding strategic support to the wider business enterprise.

- Customised Implementation: Tax professionals collaborate to implement the software tailored to your business requirements, backed by innovative technology and dedicated local customer service.

Talk to an expert

Streamline your tax operations and enhance accuracy with ONESOURCE Corporate Tax!

Navigating Tax Worldwide, Tailored Locally

Trusted by leading firms and corporations to streamline tax planning and reporting, offering global solutions that ensure seamless compliance with complex local corporate tax laws.

- Widely Adopted: Used by three of the Big 4 accounting firms and over 400 corporations, ONESOURCE is a proven choice for efficient tax management.

Frequently asked questions

ONESOURCE Corporate Tax provides robust reporting capabilities designed to support tax analysis and planning. It offers a variety of standard and customisable reports that enable users to analyse tax data, monitor compliance, and assess tax liabilities. These reports can help identify trends, facilitate strategic tax planning, and ensure accurate financial reporting. Additionally, the software supports data visualisation and dashboard features to provide clear insights into tax positions and potential opportunities for optimisation.

ONESOURCE Corporate Tax is designed to integrate smoothly with various financial systems and tools to enhance efficiency and accuracy. The software typically offers integration capabilities through standard data exchange formats and APIs, allowing it to connect with common ERP systems, accounting software, and other financial tools. This integration facilitates the seamless transfer of data, reducing the need for manual data entry and minimising errors. For specific integration details, it's recommended to consult with Thomson Reuters directly or refer to their technical documentation and support resources to ensure compatibility with your existing systems.

The software handles updates to tax regulations and policies by leveraging industry-leading insights and content that are continuously vetted by Big 4 experts. It ensures you remain compliant with the latest ATO requirements. The software solution is designed to automatically integrate these updates, providing timely notifications and alerts to keep you informed of any changes, allowing you to focus on your business while maintaining compliance with evolving regulatory requirements.

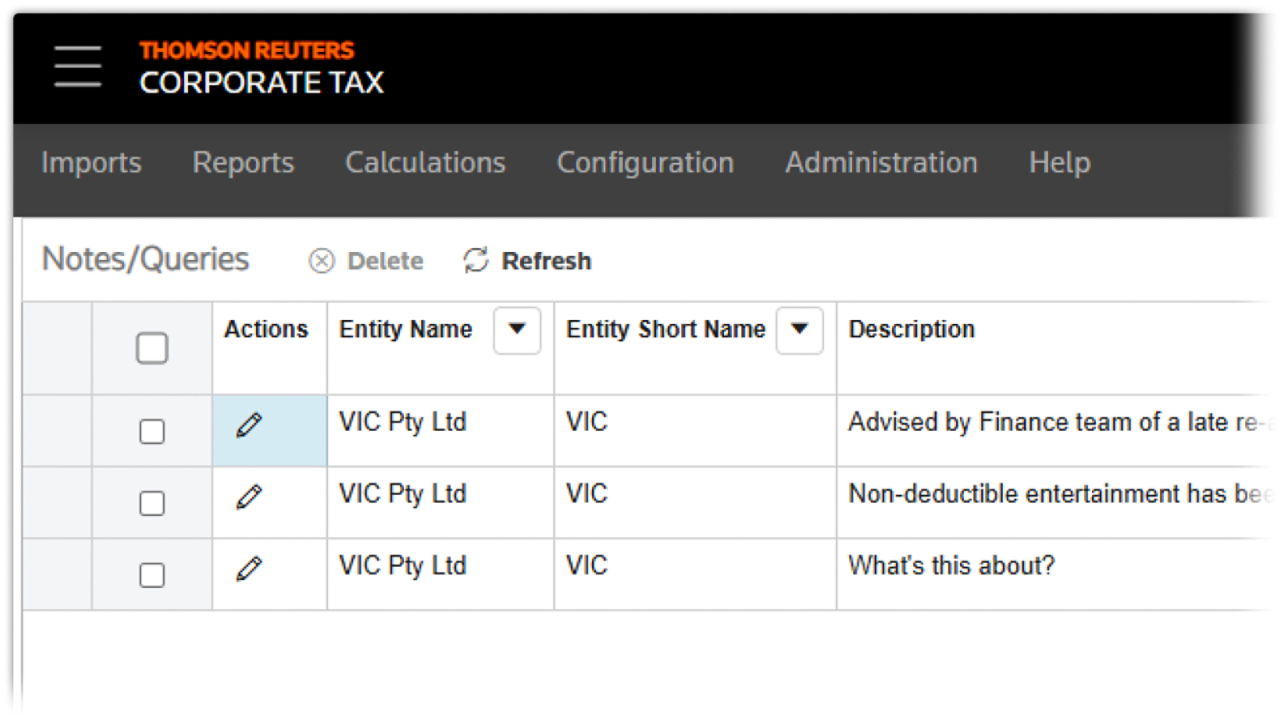

ONESOURCE Corporate tax enhances data accuracy and accountability by providing a comprehensive audit trail that records all user activities and changes. This feature links numbers to their original sources, reducing the risk of errors. Additionally, it offers granular access controls, allowing administrators to assign specific permissions to users based on their responsibilities, ensuring secure and appropriate data handling.

Experience it for yourself

Streamline your tax operations and enhance accuracy with ONESOURCE Corporate Tax!

Have questions? Contact a representative