ONESOURCE BEPS Action Manager

Stay ahead of evolving tax regulations with ONESOURCE BEPS Action Manager

Achieve effective tax transparency and compliance in a post-BEPS era through standardised and streamlined country-by-country reporting and risk assessments, using a comprehensive solution.

What can ONESOURCE BEPS Action Manager do for you?

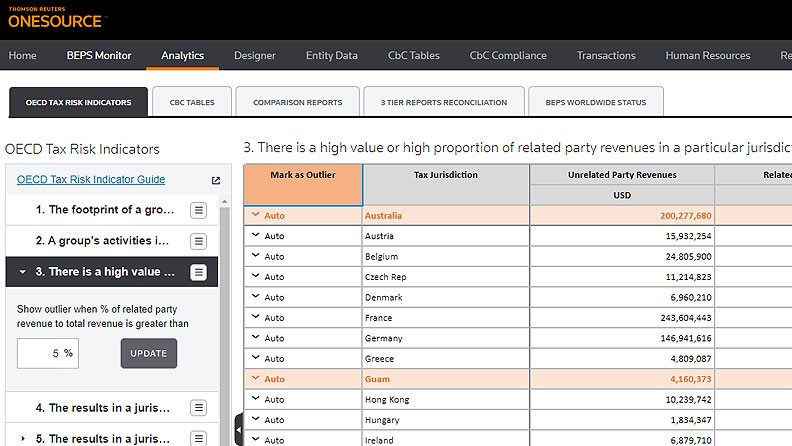

Predict, analyse, and manage tax risk

Protect your organisational reputation by proactively managing CbC risk using powerful built-in analytics (including the OECD’s 19 Tax Risk indicators) to visualise and address your company’s weak spots before your CbC report is made public.

Book my demo

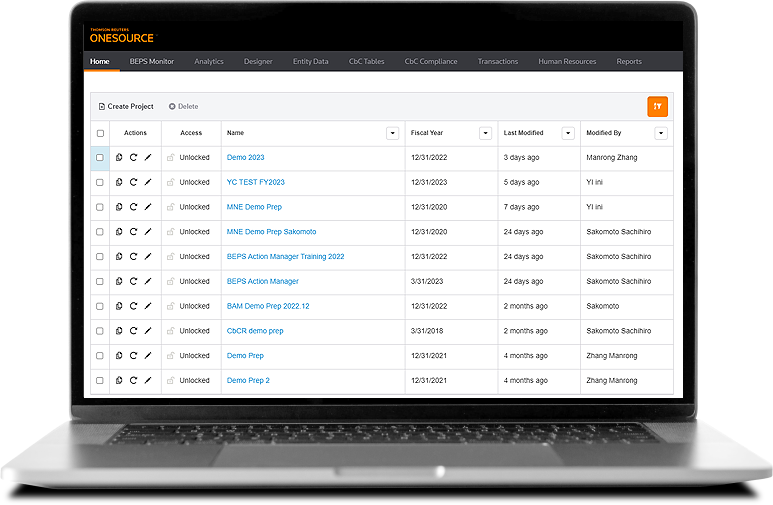

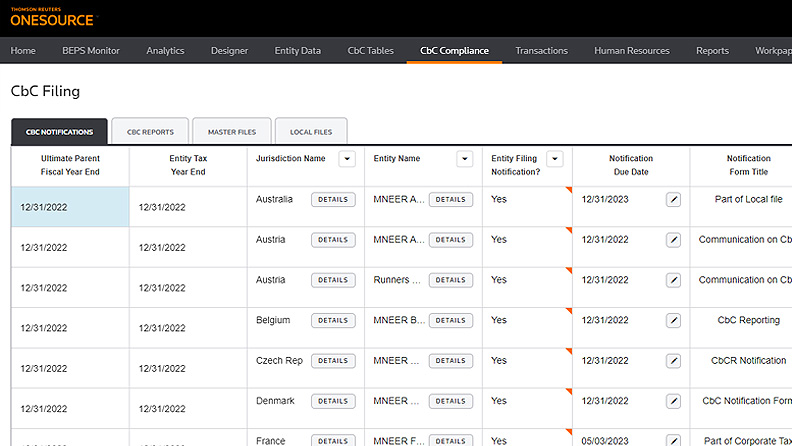

Stay ahead and achieve maximum efficiency

Track due dates for CbC reports and notifications as well as your Transfer Pricing Master File.

Book my demo

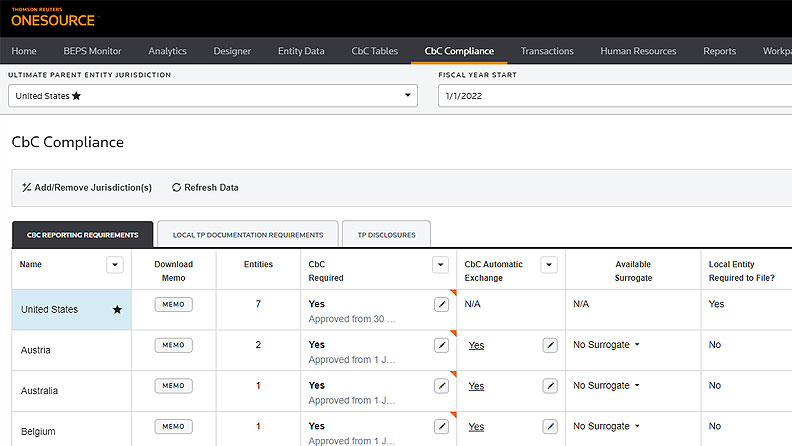

Navigate the challenges of an evolving tax landscape

Prepare your ultimate parent CbC filing in your home country, support secondary filings of your CbC in countries where the tax authority does not have Competent Authority Agreements (CAAs) for sharing, and ready your public Country-by-Country report (CbCR) for inclusion in your ESG reports to meet public CbC reporting obligations wherever you do business.

Book my demo

The value of ONESOURCE BEPS Action Manager

For companies with multiple ERP systems, it will take gross amounts of time to understand the resources and man hours necessary for compliance. A software solution with the functionality of BEPS Action Manager is crucial for achieving an accurate outcome.

Mark Moon, Senior Tax Accountant, Franklin Electric

Take control of your OECD reporting requirements with our intelligent software

Analytics with a global view

Inbuilt reporting and analytics allowing you to create various versions of your CbC report to compare data year over year or between different data sources.

Navigate evolving regulations

Get up-to-date and customised global BEPS research: local legislative rules, timings and CbC and Master File data requirements.

Simple, automated preparation

Simplify the reporting burden, producing CbC reports in country specific formats all the way to electronic submission.

Risk Management

Manage your tax data and get insights to predict risk areas, support value creation, and validate CbC and Master File reporting.

Advanced Technology

Leading web-based platform that enables stronger collaboration across departments and geographies.

Tax Transparency

Ensure global consistency and transparency of data. Automatically allocate tax structures and jurisdictional rules while maintaining quality control for precise CbC reporting. .