Orbitax Global Minimum Tax features

Global Minimum Taxation Features | Pillar 2

Learn how Thomson Reuters can help navigate through the regulations around global minimum tax.

Data Management

Novel data management software that ensures your data collection, configuration and transmission is simplified, error free and effective

Four modes of data collection such as:

- Field mapping that utilises the intuitive data mapping tool to connect the source data to the corresponding data fields in Orbitax Global Minimum Tax solution

- 90+ out of the box API connections with ERP systems, tax systems including ONESOURCE Tax Provision and others

- Data survey tool to send out questionnaire to gather responses from different stakeholders

- Manual excel upload

Pre-defined input templates

Six pre-defined smart data input templates for: Entity data, Transaction data, Globe Income, Covered Taxes, CbCR Safe Harbor Input and additional information

Format agnostic

Data collected in any format, including excel and pdf can be easily converted to a single QNR format for further use

Reduce Errors

Automated and real-time calculations for effective tax rate and top-up tax liability for each jurisdiction that you operate in.

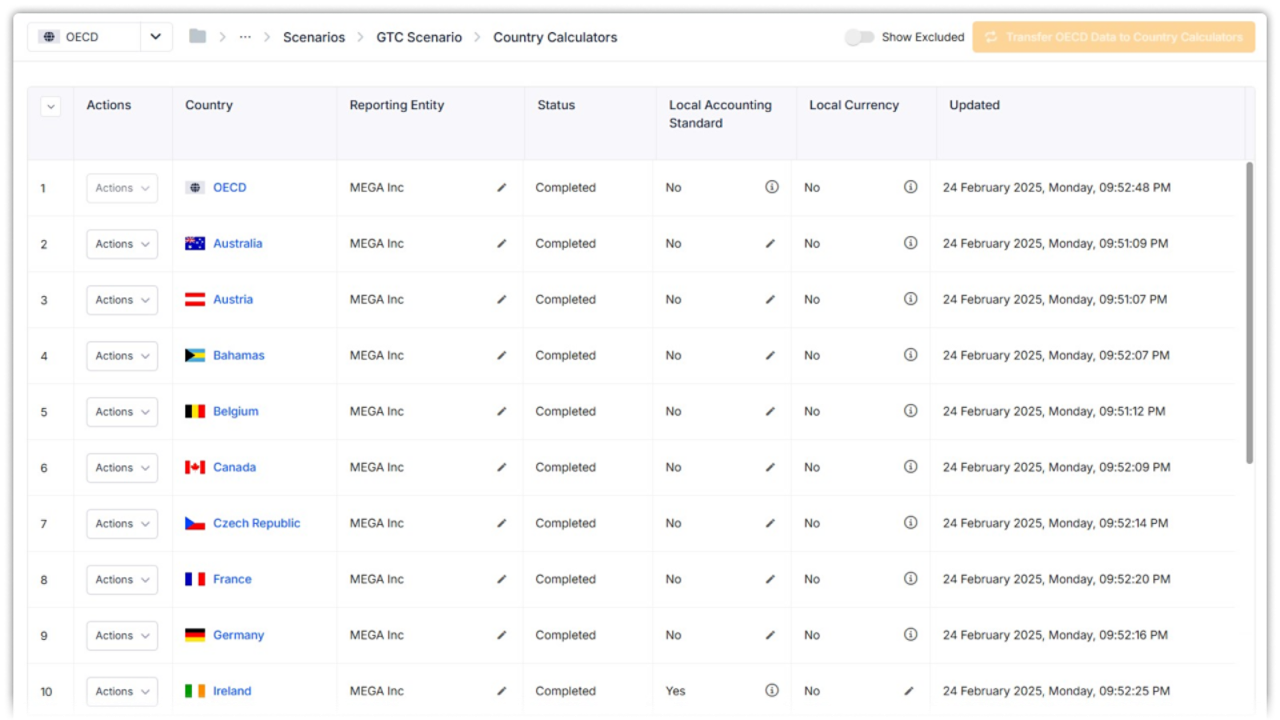

- Determine effective tax rates (ETR) and top-up tax liability for each country that you operate in using in-built tax rates for 190+ countries for STTR calculations, and pre-defined country-specific calculators for IIR, UPTR, and QDMTT. Pre-defined rules and logics ensure that country-specific calculators run concurrently and in the required sequence, based on GMT related local laws.

- Easy jurisdiction wise election settings. Create and run ‘what if scenarios’ for entity and transaction changes

- Easy to download and view online the calculation templates with separate areas for inputs, calculations, and reports (full audit trail available)

Talk to an expert

Simplify your compliance process while maximizing efficiency through Orbitax Global Minimum Tax!

Efficient reporting and compliance

Meet global compliance requirements for STTR and GloBE rules in all jurisdictions with Pillar 2 filing obligations.

- Pre-linked formats for GloBE information returns or other tax forms, as applicable

- Complete report view in Microsoft Power BI with multiple configurable visuals for viewing and presenting results summaries, scenario comparisons, and year-over-year changes

- Top-up tax adjustments or other relevant information can be pushed back to ONESOURCE Tax Provision or other tax & accounting systems for further use

- Orbitax’s Executable Actions Tool provides pre-defined intelligent workflows, that can be configured to automate tasks such as collection of data, performing calculations and auto-population of compliance forms and other reports. Workflows are customisable depending on different data requirements, with visual review and tracking such as scheduled start and end, sequential steps, & role-based tasks.

Frequently asked questions

Pillar 2 demands centralised compliance processes due to its cross-jurisdictional complexity and the need for strict sequencing of calculations.

The Orbitax GMT solution provides a comprehensive platform that automates the entire Pillar Two compliance process through centralised calculations and data flow with accurate sequencing & reduced time for collaboration. By automating routine tasks and streamlining compliance process, the solution enables MNCs to engage with local tax advisors for more value addition and strategic tasks.

Yes, Orbitax GMT maintains a comprehensive library for Pillar 2, wherein, rules are tracked by jurisdiction across data points, effective dates, calculations and compliance, and how those deviate from OECD rules.

Yes, the solution will support all local country filings related to GMT, like GIR and other country specific forms including registration forms/notification forms, including e-filings where supported.

Yes, API connections are available for ERP and other systems through Orbitax Connect. Seamless integrations can be done with a wide range of systems like SAP, ONESOURCE Tax provision and many more using 90+ out of the box connectors. Custom connections can also be developed to fit your company’s unique requirements.

Experience it for yourself

Simplify your compliance process while maximising efficiency through Orbitax Global Minimum Tax!

Have questions? Contact a representative