ONESOURCE Indirect Tax Compliance

Automate GST, VAT & Indirect Tax compliance anywhere, easily.

Streamline corporate and indirect tax compliance globally by automating GST, VAT, and sales tax for accurate international tax returns and filings.

Learn more about ONESOURCE Indirect Tax Compliance

Comprehensive Global Compliance

- Efficient Compliance: Streamlines indirect tax compliance with a modern, intuitive design for faster results.

- Comprehensive Automation: Automates VAT and GST compliance, manages risk with process controls and a digital audit trail.

- Global Scalability: Supports tax filings in over 60 countries and handles new jurisdictions and digital reporting requirements.

- Continuous Updates: Ensures compliance with the latest regulations through ongoing updates by the Thomson Reuters® tax research team.

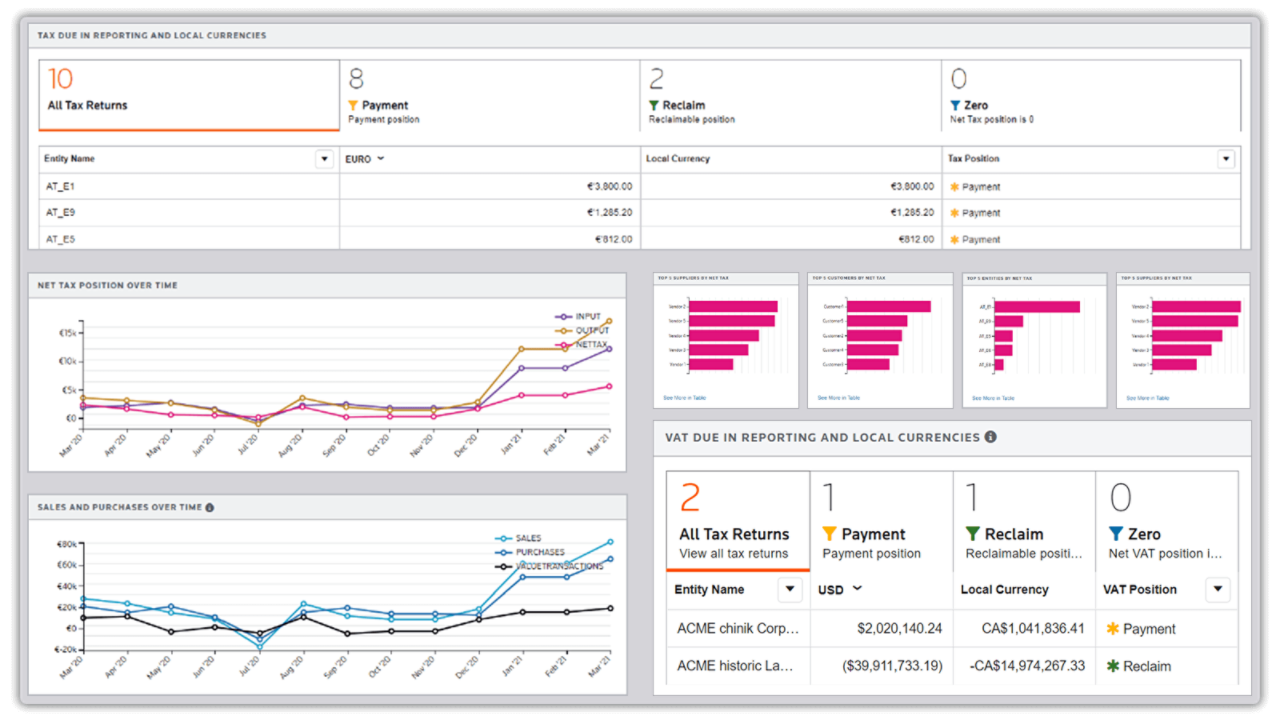

Reimagined user interface with real-time dashboards

- Powerful Dashboards: Access downstream analytics and visualize trends with simple yet powerful dashboards, handling unlimited internal and external data.

- Informed Decisions: Make more strategic decisions by viewing tax liabilities across countries and identifying potential issues through detailed drill-downs.

- Enhanced Compliance: Improve compliance and achieve better oversight by identifying and addressing data anomalies at their source.

- Business Intelligence: Gain insights that enable higher-level business improvements beyond tax compliance.

Talk to an expert

Ready to reduce complexity and ensure global compliance? Take the first step towards streamlined and compliant tax operations.

Meet all your filing requirements around the globe

- Global Standardisation: Automates the production of indirect tax returns and filings, standardising processes across your business and importing data from existing ERP systems.

- Comprehensive Filing Management: Handles complex filings such as MTD, SAF-T, Polish JPK, UAE Audit File, Oman Taxpayer Checklist, and Spanish SII, producing ready-to-submit files.

Tailor your data to meet your needs

- Effortless Data Management: Easily manage and analyse historical and real-time data for better planning and decision-making.

- Enhanced Accuracy and Agility: Improve tax accuracy and business agility, boosting the value of your tax department.

- Customisable Reporting: Validate, interrogate, and drill through data; create custom reports with comprehensive analysis and ensure data integrity.

Frequently asked questions

VAT (Value-Added Tax) or GST (Goods and Services Tax) compliance is crucial for businesses to avoid legal penalties and maintain their licenses. It ensures accurate financial reporting and cash flow management, while building trust with stakeholders and enhancing market credibility. Proper compliance streamlines operations, facilitates international trade, and fosters positive relationships with tax authorities. Additionally, it contributes to public revenue, supporting essential government services and infrastructure. Overall, VAT or GST compliance is vital for legal, financial, reputational, operational, and strategic reasons.

Automating your GST or VAT returns can streamline your compliance process and reduce errors. By using tax automation software like ONESOURCE Indirect Tax Compliance, you can seamlessly integrate with your existing ERP or accounting systems to import transactional data automatically. Configure the software with specific tax rules, automate data collection, generate and validate returns, and electronically file them with the appropriate tax authorities. Regularly monitor updates, review, and audit the automated processes to ensure ongoing compliance and accuracy. This approach minimizes manual effort and helps maintain compliance with tax regulations.

To de-risk your organization and ensure compliance with indirect tax laws, stay updated on the latest regulations, implement tax compliance software, and maintain accurate transaction records. Regularly consult with tax professionals, conduct internal audits, and provide ongoing training for your team. These steps will help minimize risks and ensure your organization meets all statutory requirements.

Automating GST and VAT tax compliance processes is crucial for protecting your organization from audits because it reduces the risk of human error, ensures timely and accurate filings, and enhances overall efficiency. Automation helps maintain precise records, streamlines reporting, and provides real-time compliance updates, significantly lowering the likelihood of non-compliance and costly penalties during audits.

Experience it for yourself

Schedule your demo today and streamline your corporate and indirect tax compliance globally.

Have questions? Contact a representative